About Us

Achieve financial freedom through Multifamily Real Estate Investing

We are multifamily market experts having years of hands-on market knowledge and Relationships from dispositions and acquisitions to financing and property management. Our network has unparalleled expertise and a deep understanding of every facet of the Multifamily market.

Our Managing Partners

Illya Scott | Co-Founder & CEO

Illya Scott is the co-founder of E & I Capital Partners and serves as one of its Real Estate Syndicators. Illya is married with six children and resides in Aurora Colorado. His faith and love for his family are the driving forces for him to always operate in the spirit of excellence. Along with Real Estate Syndication, Illya has been an active licensed Real Estate Agent in the State of Colorado since 2019. As a Real Estate Syndicator, Illya applies the same core values to thoroughly manage contacts successfully to the closing table as he does in the residential world of Real Estate.

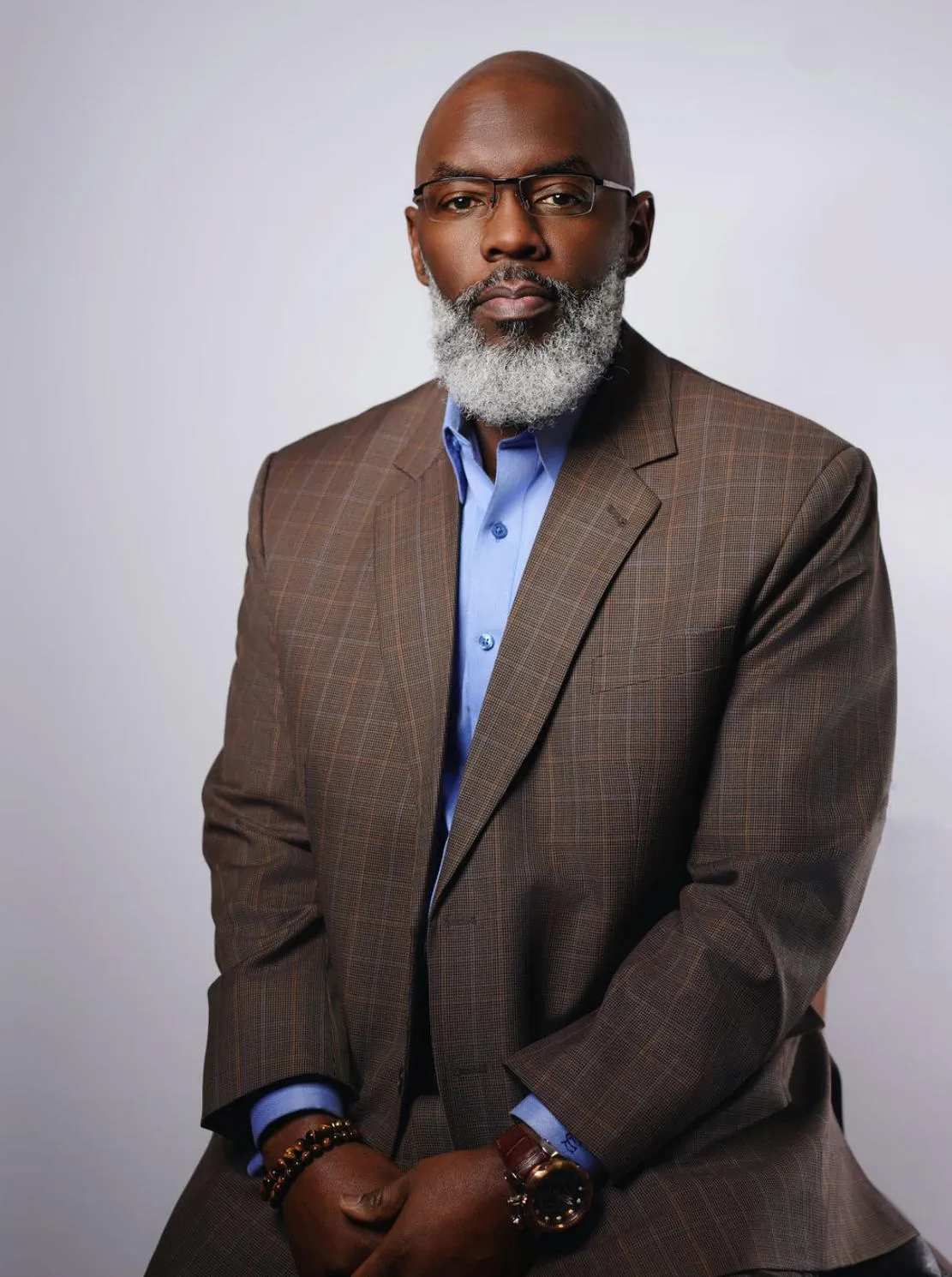

Earnest Collins Jr | Co-Founder & CEO

Earnest Collins Jr is the co-founder of E & I Capital Partners and serves as one of its Real Estate Syndicators, best known for serving as the head coach of the University of Northern Colorado from 2011 to 2019. Before that, he held various coaching positions, including roles at Alcorn State, University of Kansas, UCF and Northwest Missouri State where they won Back to Back National Championship (98,99). A former defensive back at UNC, he built a career focused on player development and defensive strategies. Alongside coaching, he has established himself in the multi-family real estate sector, leveraging his leadership skills to manage and invest in income-generating properties. Collins balances his passions for coaching and real estate while cherishing his family—his wife, Tabatha, their three children, and three grandchildren. Guided by his life motto, "If you are living life for yourself, you are living a wasted life," he continues to make a meaningful impact in both sports and business.

Our Core Values

Integrity

Integrity is the cornerstone in the foundation of E & I Capital Partners. It ensures that we will always operate in "the spirit of excellence" when serving our clientele. Establishing and maintaining Integrity in E & I Capital Partners, ensures that current and future investors, piece of mind that their deals will be sound with regular thorough updates until the exit of the investment.

Service

Providing a high level of Service before, during, and after each transaction is vital to building solid and trustworthy business relationships. At E & I Capital Partners, we believe that great service should be second nature and not a practice that requires a concentrated effort when interacting with all clientele.

Competency

All team members and partners are vetted to ensure they are well versed in their area of assignment given. Continued education/training is a requirement at E & I Capital Partners, to ensure our clients are represented with competent professionals.

Our Advisory Board

Tyler Deveraux

Advisor

Tyler is the founder and CEO of Multifamily Mindset, the #1 multifamily education company in the nation, and has helped his mentorship clients acquire just shy of $1 billion of multifamily assets. He is also the founder of AXXIS Capital, an investment firm that has acquired over $400M in commercial real estate and generated nearly $80M in profits for investors across the 13 deals he has taken full-cycle.

Tyler is a 3 x Best Selling Author and master educator, training over 50k new and seasoned investors at his transformative live events to Think BIGGER, Live BETTER, and Own A Shit Ton of Real Estate. Tyler now lives in Maui, HI with his wife, Brittany and their two beautiful kids Paxton & Marley.